Startup Profile

The problem we're solving

Current informal lending practices often suffer from lack of proper documentation, inefficient manual tracking, limited visibility into loan performance, and inconsistent borrower communication leading to long legal battles and stress for both parties.

Our solution

Our SaaS platform targets P2P lending between friends and family, micro-finance institutions, individual money lenders, and small businesses extending credit. Our web and mobile apps enable users to: ● Set up loans with clear digital agreements. ● Accurately schedule and track payments. ● Flexibly adjust EMIs (equated monthly instalments) ● Access real-time loan performance dashboards. ● Utilise automated reminders and follow-ups. ● Access local lawyers and firms for legal help

Our differentiator

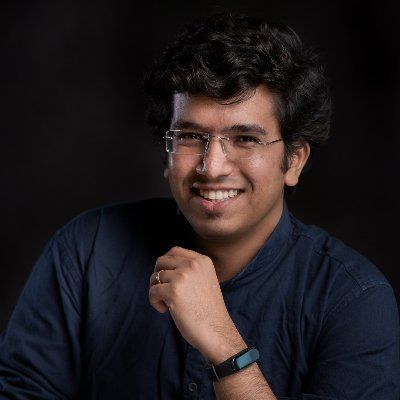

My family's $50K lending business, managed via diary, provided first hand experience in the problems of this segment. My previous UPI payments startup revealed diverse informal lending use cases, from P2P loans to small businesses extending credit. As a serial entrepreneur and CEO with 8 years in fintech, including a successful exit, I bring strong industry knowledge. My family's 25 year lending experience further deepens our understanding of the sector's pain points and opportunities.

Biggest achievement

Market validation came swiftly: a 3-day startup exhibition in Mumbai yielded paid pre-orders for ~5000 loans worth $30k. Interest from UAE and Philippines visitors demonstrated global demand, confirming both the need and market fit for our solution.